Investing in small cap mutual funds can offer high returns for those willing to accept higher risk. Small cap funds invest into growing small companies, which have significant growth potential but also come with higher volatility. In this article, we will discuss the top 5 small cap mutual funds in India based on various performance metrics.

Here we will discuss how to find the top 5 small cap mutual fund with the help of ” Trendlyne ” website.

Steps to Identify the Top 5 Small Cap Mutual Funds:

1. Open Trendlyne: Start by opening the Trendlyne website in your browser.

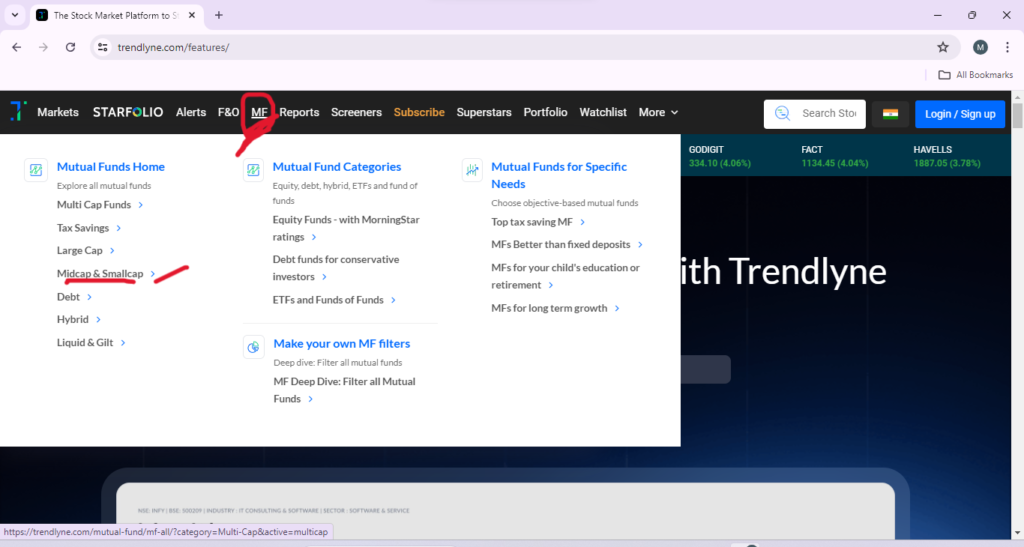

2. Select MF Category: Navigate to the Mutual Funds (MF) section from the top menu and select the Small and Mid Cap category.

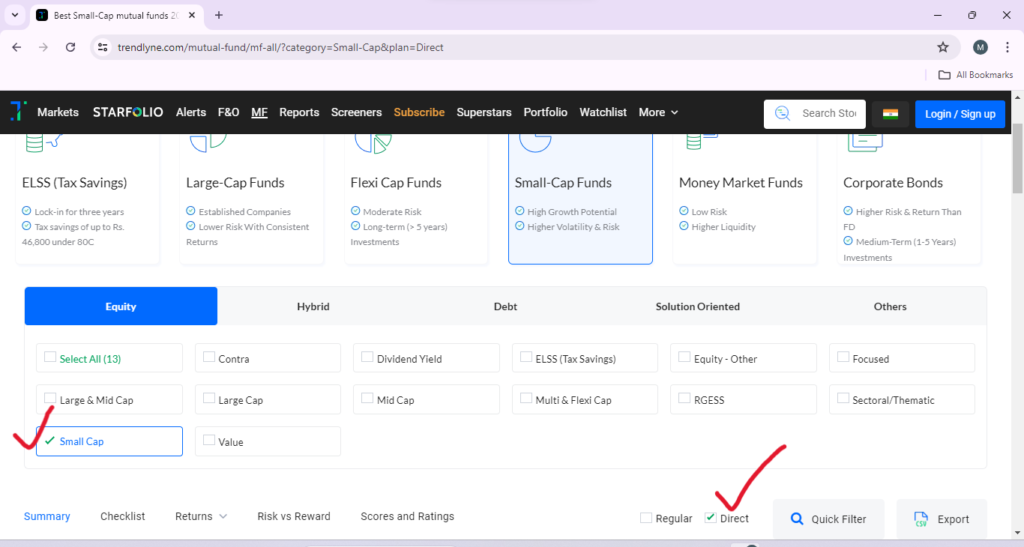

3. Filter for Small Cap: Unselect the mid cap option to focus solely on small cap funds. Ensure you click on the direct plan tab for direct growth options.

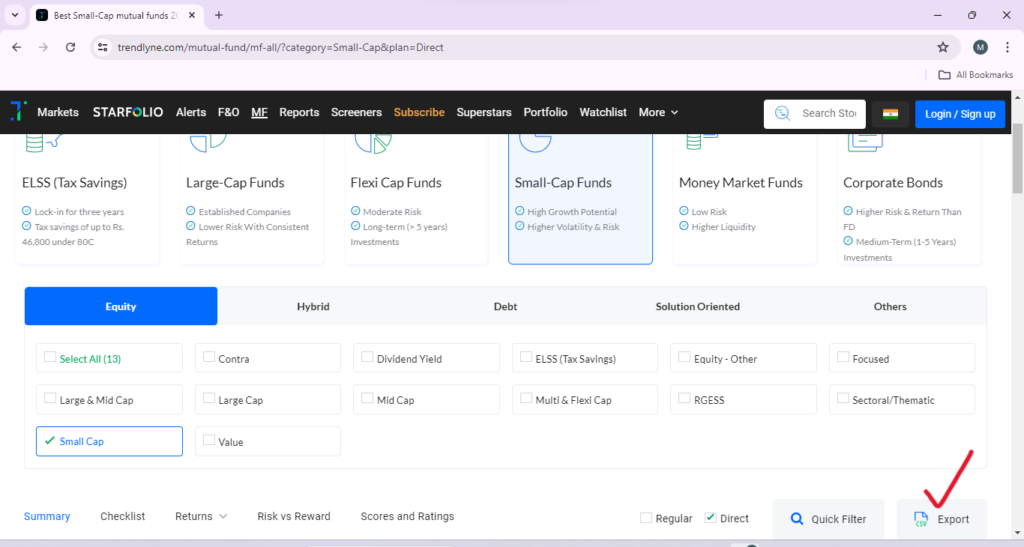

4. Export Data: Export the filtered data to a CSV file for further analysis.

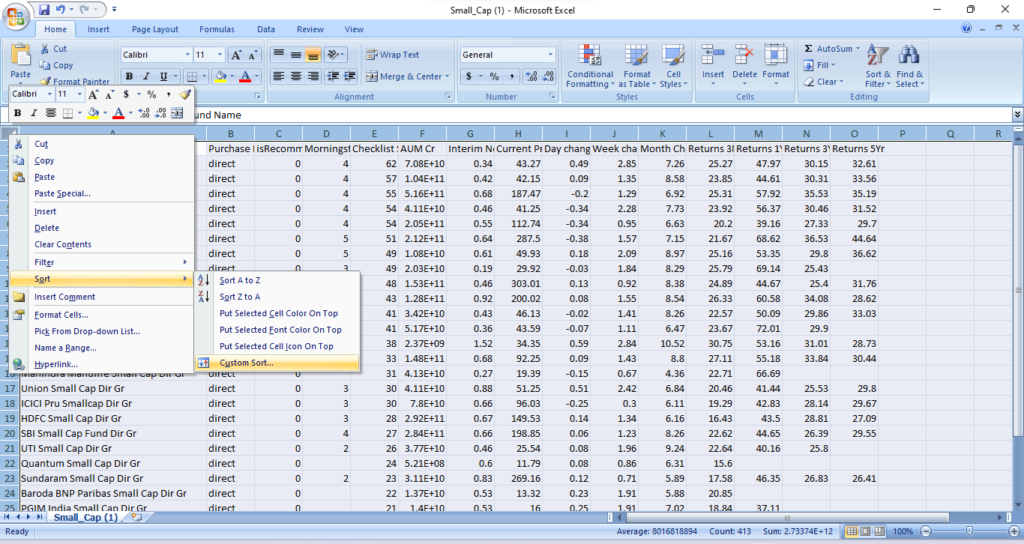

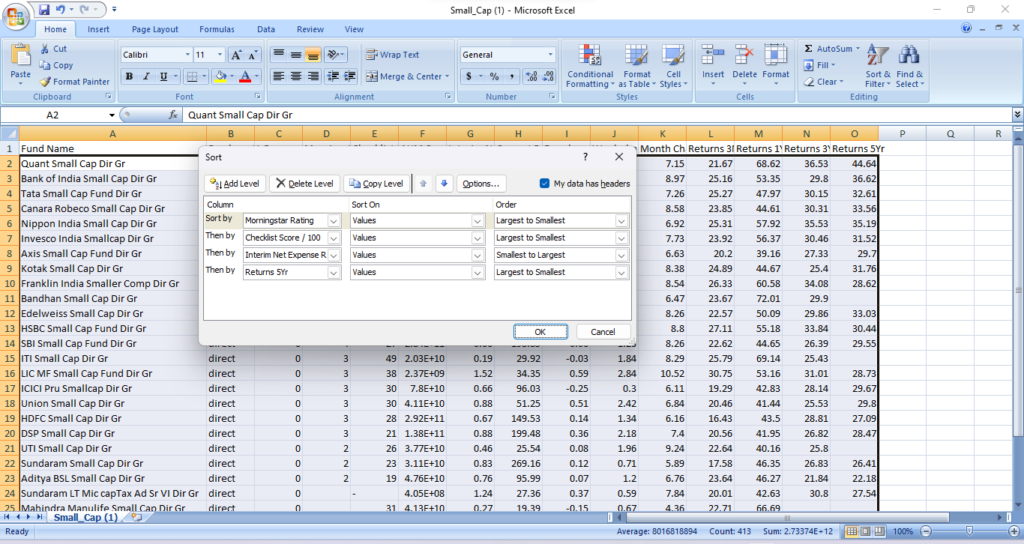

5. Open CSV in Excel: Open the exported CSV file in Microsoft Excel. Select the entire data range, right-click, and choose the sort option.

6. Sort Data: Customize the sort order based on the following criteria:

Cells Checklist Score: Largest to smallest

Morningstar Rating: Largest to smallest

Expense Ratio: Smallest to largest

5 Year Return: Largest to smallest

7. Retain the 1-year return field and delete the rest for a simplified view.

Conclusion.

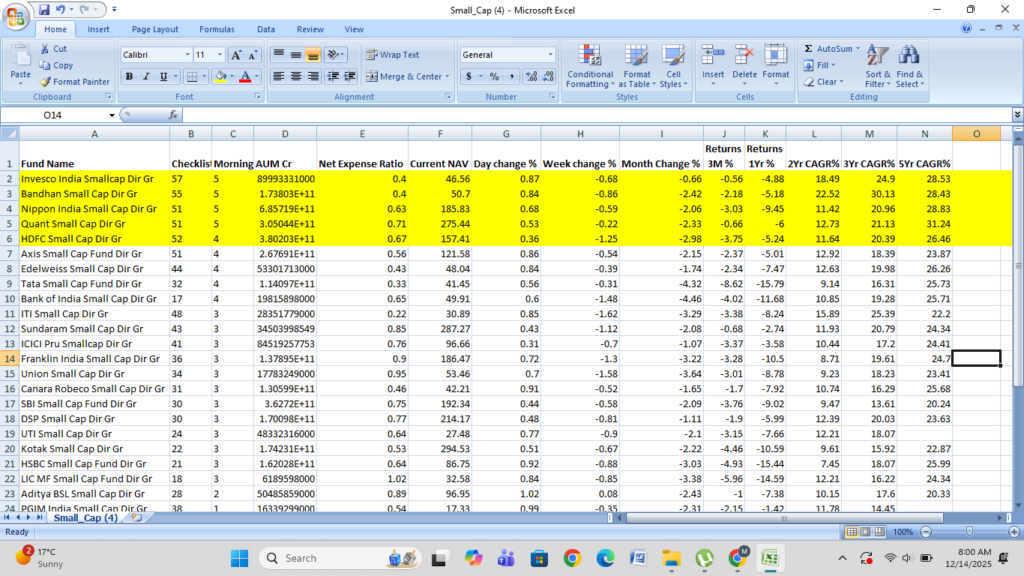

By following these steps, we can identify the top 5 small cap mutual funds based on a comprehensive analysis. Here are the top performers:

1. Invesco India small-cap direct growth

2. Bandhan Small cap direct Growth

3. Nippon India Small Cap Direct Growth

4. Quant small cap direct growth

5. HDFC small cap direct growth

Note: Investing in small cap mutual funds can be a lucrative option for those looking for high returns, can take higher risk. The funds listed above have demonstrated strong performance across various metrics, making them some of the best options in the small cap category. Always consider your risk tolerance and investment horizon before making any investment decisions.